Introducing...

1Wallet is your no-cost Personal Financial Management tool! Save hundreds of dollars every year by tracking spending, setting goals and establishing realistic budgets.

With 1Wallet, you'll know where your money goes, how much you are saving, and be able to set goals and track progress. PLUS, you can now sync accounts from other financial institutions.

- Get your complete financial picture.

- Review and understand your spending habits.

- Make informed choices with the cash flow calendar.

- Visually track your progress to reach financial goals quicker and easier.

- Stay informed with account alerts.

- Monitor your total assets and debt for up-to-date net worth.

Login to your FirstCU Online account to GET STARTED!

Quick Tips to Access 1Wallet on a mobile device

- Sign in to your FirstCU Online Account

- Select the hash mark in the upper left corner of your dashboard

- Select “Spending Habits” from the list

Quick Tips to Access 1Wallet on a computer

- Sign in to your FirstCU Online Account

- Click on an account on your dashboard

- Select “Spending Habits” from the pop-ups

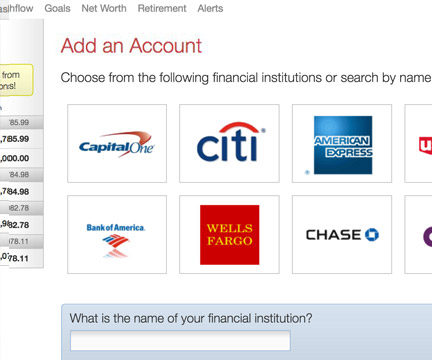

Add an Account

Syncing other accounts for a complete financial picture is simple. Then you can track your account relationships with almost all financial institutions automatically, including credit card providers and investment firms. Once all of your accounts are synced, track spending, set budgets, calculate your net worth and more.

Step 1: Select "Add" above your current account listing.

Step 2: Select an institution or use the search to find your institution.

Step 3: Enter in the required information and select "Connect".

Step 2: Select an institution or use the search to find your institution.

Step 3: Enter in the required information and select "Connect".

You'll receive a notification on your dashboard once the account has been synced successfully.

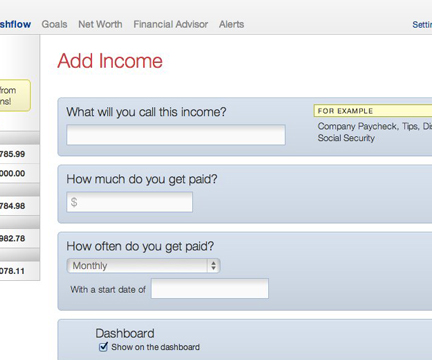

Cash Flow Calendar

The cash flow calendar brings your budget to life through an interactive calendar. With the calendar you can see how much money you have available to pay bills and other expenses day by day... allowing you to make informed choices on when to schedule bills and other spending.

Step 1: Navigate to the "Cashflow" tab.

Step 2: Select "Add Income" or "Add Bill" from above the calendar view.

Step 3: Complete the required fields

(Name your bill/income, how much and often you get paid or what amount is due).

Step 4: Click the "Add Bill" or "Add Income" button on the bottom of the form.

Step 2: Select "Add Income" or "Add Bill" from above the calendar view.

Step 3: Complete the required fields

(Name your bill/income, how much and often you get paid or what amount is due).

Step 4: Click the "Add Bill" or "Add Income" button on the bottom of the form.

Your bill or income will now appear in the calendar for you, whether it’s a monthly, weekly or quarterly payment.

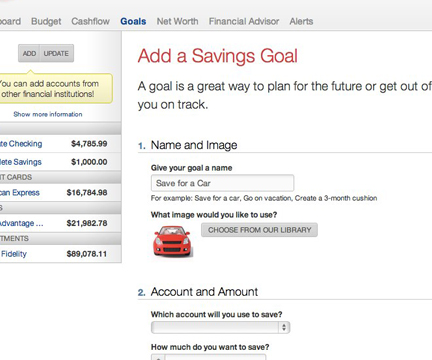

Goals

Visually tracking your financial goals can help you take control and makes reaching your goals much quicker and easier. Create savings goals, like saving for a vacation, or a debt reduction goal, like paying off a high-rate credit card.

Step 1: Select "Add A Goal" on the goal dashboard.

Step 2: Select your desired pay off or savings goal.

Step 3: Fill in the required information.

Step 4: Click the "Create" button to complete the process of adding a new goal.

Step 2: Select your desired pay off or savings goal.

Step 3: Fill in the required information.

Step 4: Click the "Create" button to complete the process of adding a new goal.

Keep in mind, your Goal Summary at the bottom of the page will update your completion date and the amount needed per month according to your preferences in the form.

Goals will automatically update your progress and will reflect your day-to-day account balances.